jersey city property tax assessment

City of Jersey City. Real property is required to be assessed at some percentage of true value established by the county board of taxation in each county.

Township Of Teaneck New Jersey Tax Collector

All 21 counties in New Jersey have chosen 100.

. City of Jersey City. The tax rate is set and certified by the Hudson County Board of Taxation. The budget is more than a 15 increase from last years budget and will raise school taxes on the average Jersey City homeowner next year by 1600.

By using this website you acknowledge that you have read understood and agreed to the above conditions. Costs along with bidding instructions please visit. THE OFFICE OF THE CITY ASSESSOR SHALL.

The median property tax in New Jersey is 189 of a propertys assesed fair market value as property tax per year. Online Inquiry Payment. LOS ANGELES CA 90071 Deductions.

JERSEY CITY NJ 07302 Deductions. Line auction on June 22 2021 900 am. You can also locate your tax record online here.

The office of the City Assessor shall be charged with the duty of assessing real property for the purpose of general taxation. The City of Jersey City Tax Assessor will appraise the taxable value of each property in his jurisdiction on a yearly basis based on the features of the property and the fair market value of comparable properties in the same neighbourhood. 2020-2021 and prior year delinquent taxes.

And other municipal charges through an on-. Property records requests for Hudson County NJ. Civil Solutions has designed a Jersey City Tax Map Viewer application for informational purpose.

The city is responsible for mailing tax post cards to property owners. The assessed value is determined by the Tax Assessor. The assessors office can provide you with a copy of your propertys most recent appraisal on request.

The Division of Tax Assessments is administratively part of the Department of Finance. If you have documents to send you can fax them to the City of Jersey City assessors office at 201-547-4949. ARH has been surveying and mapping since the companys start in the 1930s.

Online Inquiry Payment. New Jerseys equalization program is designed to ensure that each taxing district as a whole is treated equitably. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

Online Inquiry Payment. However the County Board of Taxation maintains legal supervision and oversight of this Division. Account Number Block Lot Qualifier Property Location 638 14503 00003 53 ESSEX ST.

New Jerseys median income is 88343 per year so the median yearly property tax paid by New Jersey. Several government offices in Jersey and New. TAXES BILL 000 000 55321 0 000 2022 3.

You can call the City of Jersey City Tax Assessors Office for assistance at 201-547-5132. 11 rows City of Jersey City. Public Property Records provide information on land homes and commercial properties in Jersey including titles property deeds mortgages property tax assessment records and other documents.

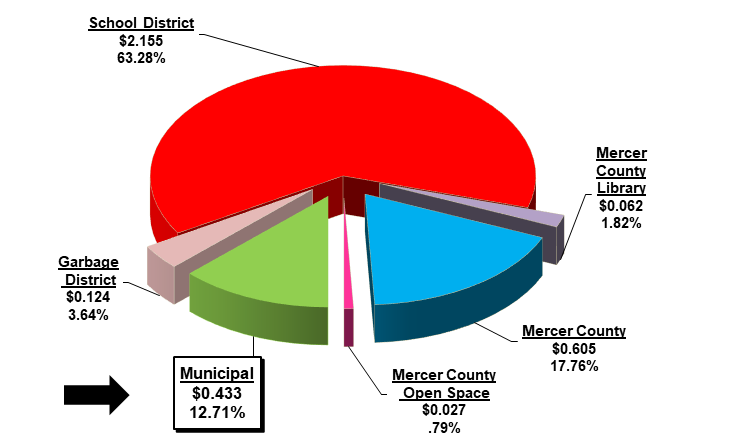

JERSEY CITY NJ 07302 Deductions. Property taxes in Jersey City are calculated based on the Total Assessed Value of the property land value improvements value - exemptions divided by 100 and multiplied by the tax rate. Please call the assessors office in Jersey City before.

11605 00001. TAXES BILL 31290712. Value all real and personal property in the city for the purposes of assessment and taxation in accordance with general law the Charter and applicable provisions of the Jersey City Code.

The increase comes one year after a nearly. You may contact the Jersey City Tax Collector for questions about. 30 MONTGOMERY STREET LPay Date.

515 S FLOWER ST 49TH FL Bank Code. Contact the Jersey City tax office if you dont yet have your updated assessment or cannot find your tax record. City of Jersey City.

Account Number Block Lot Qualifier Property Location 676180 07302 00009 C1912 75 PARK LANE SOUTH View Pay. A Jersey Property Records Search locates real estate documents related to property in Jersey New Jersey. A listing of all parcels delinquencies and.

Tax amount varies by county. The City of Union City announces the sale of. Find Jersey residential property records including owner names property tax assessments payments rates bills sales transfer history deeds mortgages parcel land zoning structural descriptions valuations more.

Enter an Address to Receive a Complete Property Report with Tax Assessments More. TAXES BILL 000 000 50000 0 000 2034 4. Civil Solutions is the dedicated Geospatial Technologies Department of Adams Rehmann and Heggan ARH.

Official records of the Jersey County Supervisor of Assessments and the Jersey County CollectorTreasurer may be reviewed at the Jersey County Government Building 200 North Lafayette St Jerseyville IL 62052. Jersey City NJ 07306 Phone. 3 To inquire about the appeals process you can contact the Hudson County Tax Board whose website is here.

Search by - Block Lot Historic Block Lot Address Map Sheet. Online Inquiry Payment. Ad Search County Records in Your State to Find the Property Tax on Any Address.

New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes. The Senior Freeze Program reimburses eligible senior citizens and disabled persons for property tax or.

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

The Official Website Of City Of Union City Nj Tax Department

A New Way To Access Property Records Citygeo City Of Philadelphia

Coronavirus Jersey City Cases Updates And More May 2022 Jersey City Upfront

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Property Tax Info Township Of Irvington New Jersey

Tax Finance Dept Sparta Township New Jersey

Tax Collection Franklin Lakes Nj

Official Website Of East Windsor Township New Jersey Tax Collector

The Official Website Of City Of Union City Nj Tax Department

Pavonia Branch Jersey City Free Public Library

The Official Website Of City Of Union City Nj Tax Department